nj property tax relief homestead benefit

You met the 2018 income requirements. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes.

The Official Website Of The Borough Of Lebanon Nj News

The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the property taxes.

. If you have not received filing information in the mail or an email from us check the application mailing schedule. Under Age 65 and not Disabled Homeowners. Ad Our Tax Professionals Will Get You On The Tax Relief You Need.

Can I still file for a Homestead Benefit. 2016 2017 2018 Phone Inquiry. Check the Status of your Homestead Benefit.

Credit on Property Tax Bill. Ad Mortgage Relief Program is Giving 3708 Back to Homeowners. That would add at least 100000 to the current income cutoffs for direct property-tax relief benefits.

Under Murphys plan homeowners making up to 250000 annually would qualify for direct property-tax relief benefits averaging roughly 680. Speak with a Tax Resolution Specialist. The Homestead Benefit will reduce the tax bill of the person who owns the property on the date the benefit is paid.

This means that if you indicated you still own the home when filing your application and later sell it the only way to receive your 2018 Homestead Benefit is to take credit for the benefit at the closing of your property sale. 42 of New Jersey Homeowners and 36 of Renters 50 and Older Considered Leaving the State in the Past Year. Most recipients get a credit on their tax bills.

You can get information on the status amount of your Homestead Benefit either online or by phone. Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes.

NEW BRUNSWICK NJ April 13 2022 New Jersey homeowners and renters are fed up with paying the highest state property taxes in the nation averaging 9284 in 2021. Property Tax Relief Programs. Remove Your IRS Tax Debt Today.

150000 or less for homeowners age 65 or over or blind or disabled. Amounts you receive under the Homestead Benefit Program are in addition to the States other property tax relief programs. 1-877-658-2972 toll-free within NJ NY PA DE and MD 2018 benefit only.

Currently the average property tax benefit is 626 with eligibility limited to homeowners making 75000 or less if theyre under 65 and not blind or disabled. Fed Up New Jersey Voters Seek Strategic Property Tax Relief. How do I get an Identification Number and PIN so I can file my Homestead Benefit application.

Renters making up to 100000 would be eligible for direct payments. Check If You Qualify For This Homeowner StimuIus Fast Easy. 2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022.

Check Your Eligibility Today. How Homestead Benefits Are Paid. How much is the NJ property tax credit.

Property Tax Relief Programs. 75000 or less for homeowners under age 65 and not blind or disabled. Online Inquiry For Benefit Years.

Check the Status of your Homestead Benefit 2018 Homestead Benefit. We can deduct any amount you owe from future Homestead Benefits or Income Tax refunds or credits before we issue the payment. Dont Miss Your Chance.

NJ Division of Taxation - Homestead Benefit Program - How Homestead Benefits are Calculated. The Homestead Benefit program provides property tax relief to eligible homeowners. NJ Taxation You can deduct your property taxes paid or 15000 whichever is less.

Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits. Frequently Asked Questions How to File. How Homestead Benefits Are Paid 2018 Homestead Benefit.

The current Homestead program funds direct benefits that total closer to 630 with those benefits only provided to senior and disabled homeowners earning up 150000 annually and all other homeowners earning up to. For New Jersey homeowners making up to 250000 rebates would be applied as a percentage of property taxes paid up to 10000. Thousands of New Jersey homeowners have begun receiving applications from the state Department of Treasury via the mail and electronically for the latest round of.

Certain seniordisabled homeowners who were not required to file a 2018 New Jersey Income Tax return will have their Property Tax Credit included with the Homestead Benefit. We will calculate your Homestead Benefit using the 2006 property taxes for the home that was your principal residence on October 1st. Property Tax Relief Programs.

Under the current state budget about 340 million was earmarked to fund Homestead property-tax relief benefits that go to thousands of seniors and disabled homeowners making up to 150000 annually and other homeowners making up to 75000 annually. Any approved benefit would be credited to your municipality and applied to your balance. My 2018 property taxes are late.

The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021. 1-877-658-2972 When you complete your application you will receive a confirmation number. New Jersey just increased funding for a key state property-tax relief program and this month homeowners across the state are getting their first opportunity to apply for those beefed-up tax breaks.

Property Tax Relief Programs. File Online or by Phone. If you were not a homeowner on October 1 2018 you are not eligible for a Homestead Benefit even if you owned a home for part of the year.

If you are delinquent in paying your property taxes you are still eligible to file an application. The Homestead Benefit program provides property tax relief to eligible homeowners. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

County Property Tax Bills Going Out In The Mail Soon New Albany Djournal Com

Disabled Veterans Property Tax Exemptions By State

Property Tax Deductions Roseland Nj

If I Sell My Home Do I Get The Homestead Rebate Biz Brain Nj Com

Fire Prevention Bureau Midland Park Nj

Deducting Property Taxes H R Block

Other Income Pub 17 Chapter 12 Pub 4012 Tab D Federal 1040 Line 21 Nj 1040 Lines 23 25 Nj Tax Ty2014 V Ppt Download

Quarterly Tax Bills Adjusted For Homestead Benefit Property Tax Credit

Disabled Veterans Property Tax Exemptions By State

Other Income Pub 17 Chapter 12 Pub 4012 Tab D Federal 1040 Line 21 Nj 1040 Lines 23 25 Nj Tax Ty2014 V Ppt Download

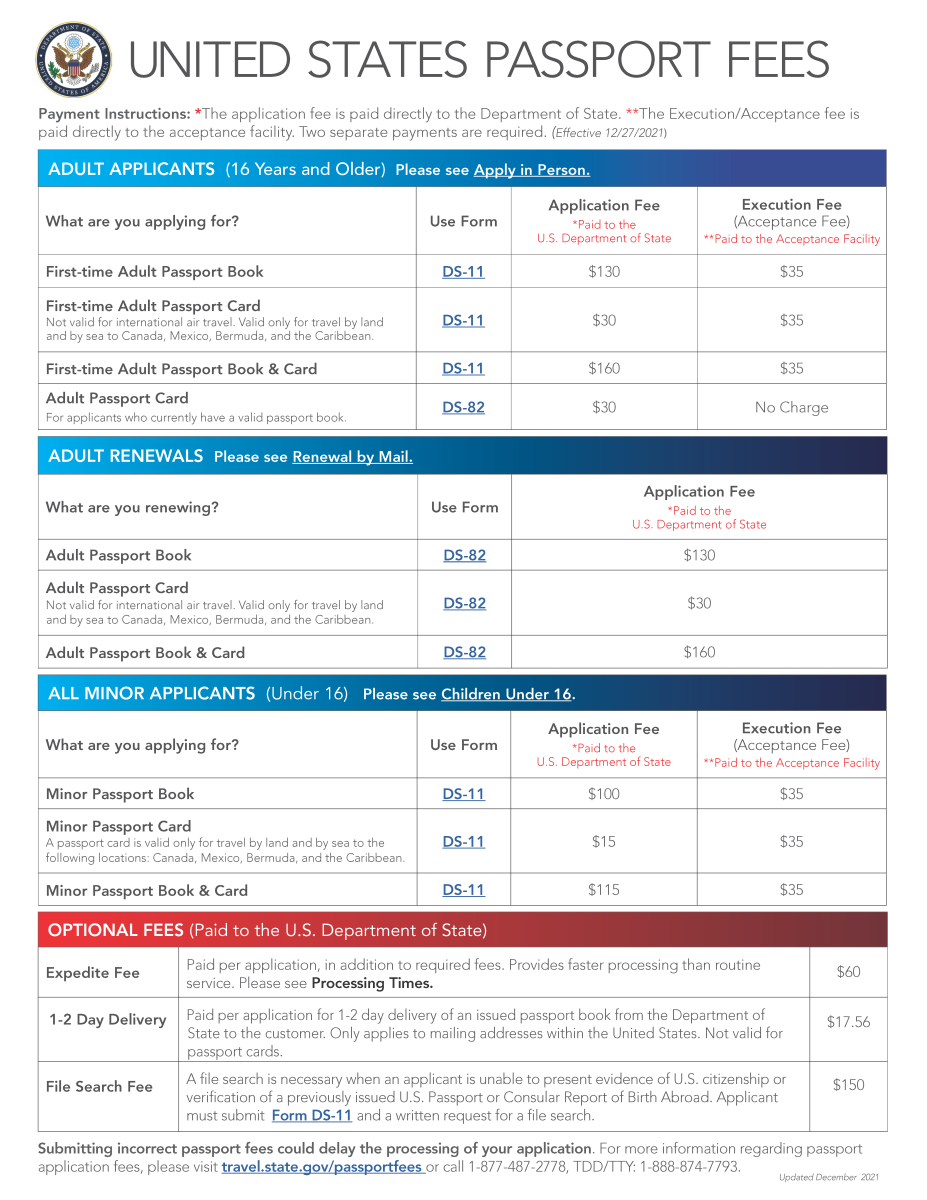

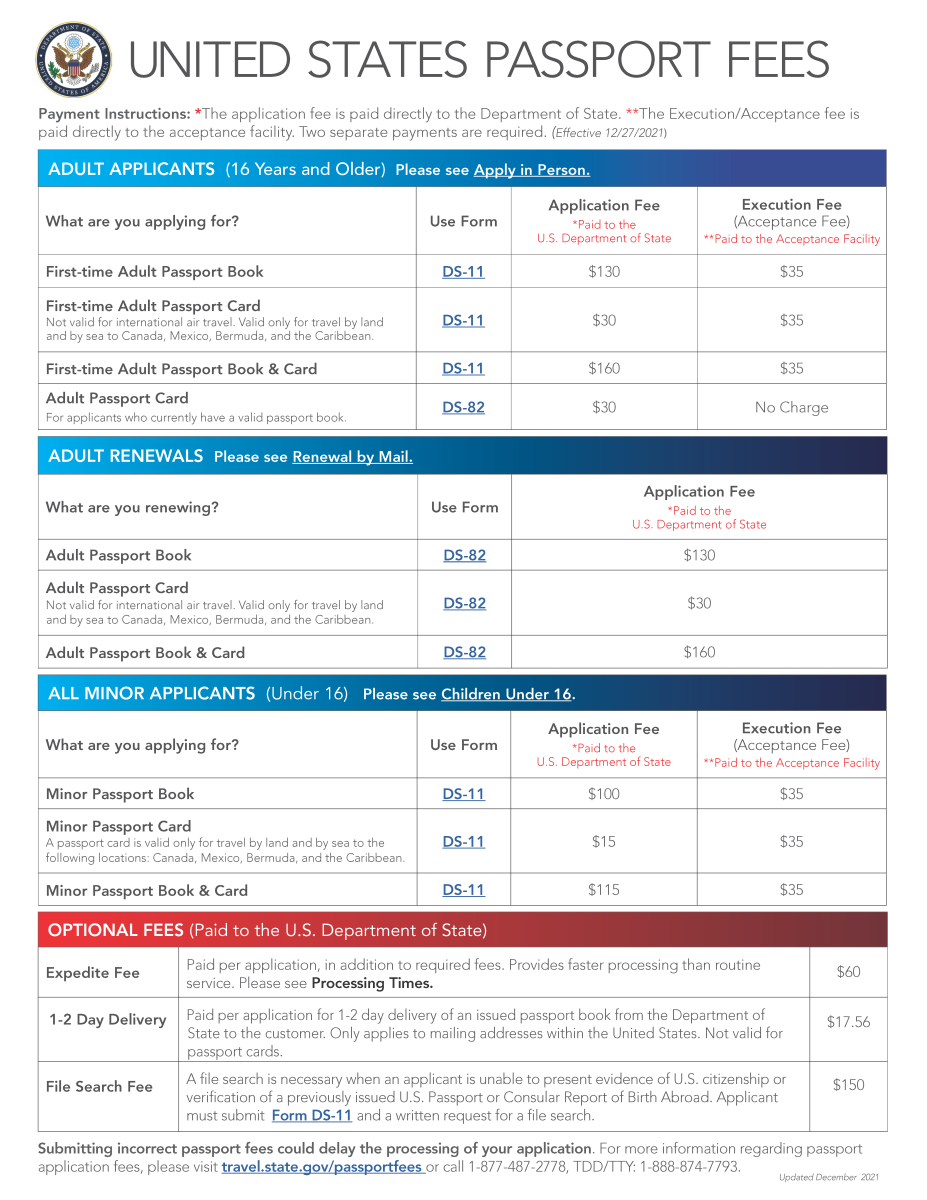

Updated United States Passport Fees Midland Park Nj

Do Property Taxes Go Down For Senior Citizens In Nj Seniorcare2share

Fillable Online Nj Tr 1040 Form Nj Fax Email Print Pdffiller